In-play football trading isn’t just betting during matches. It’s a completely different mindset.

While traditional punters place a bet and hope, traders react to live developments. They read the game flow, spot momentum shifts, and profit from market movements that happen in real-time.

Think of it like this: you’re not predicting what will happen. You’re responding to what is happening.

What Makes Trading Different from Betting

Standard in-play betting means backing an outcome and holding until full-time. You might back over 2.5 goals at 60 minutes and wait.

Trading means taking positions you can exit early. You back those same goals, watch the odds move in your favour after a near-miss, then cash out for guaranteed profit before anything actually happens.

The difference? Control.

Bettors rely on results. Traders create results from market movements.

The Core Trading Strategies That Work

Laying the Draw (LTD)

This is where most traders start. The concept is simple: when one team dominates a 0-0 or tied match, you lay the draw expecting them to score.

Here’s when it works best:

The stronger team controls possession but hasn’t scored yet. You’re seeing wave after wave of attacks. The crowd is getting restless. The pressure is building.

Enter between minutes 55-70. Earlier and you’re gambling on dominance that might fade. Later and the value has often disappeared.

Exit the moment they score. Don’t get greedy waiting for a second goal.

Correct Score Scalping

This targets temporary market overreactions. When something dramatic happens: a red card, penalty appeal, or sustained pressure: the correct score markets often swing too far.

Say Liverpool are drawing 1-1 with Brighton at home. Liverpool get a man advantage after 65 minutes. The 1-1 correct score price will lengthen dramatically as people expect Liverpool to score.

You lay the 1-1 scoreline, then green up when Liverpool create their next big chance. The market tightens again, giving you profit without needing an actual goal.

Momentum Trading

Football matches have rhythm. Teams build pressure in waves. Learn to read these patterns.

Watch for the signals: tempo increasing, shots on target rising, the defending team dropping deeper. When you see sustained pressure building, back the attacking team to score next.

Exit during the first natural break in play: throw-in, substitution, or tactical foul. Don’t wait for the goal. Trade the pressure, not the outcome.

Reading Live Match Scenarios

Let me walk you through a real example from last season.

Manchester City vs Newcastle, 0-0 at 62 minutes. City had 71% possession, 2.1 expected goals, and Newcastle were sitting deep with ten men behind the ball.

The traditional bettor might back City to win at 1.30 odds. Too short for the risk.

The trader sees the setup differently. City to score next is 1.50. That’s value given the pressure building.

At 67 minutes, De Bruyne hits the crossbar. The price drops to 1.25. You cash out for 20% profit without needing the goal.

Three minutes later, City score anyway. But you’ve already banked your profit and moved on to the next opportunity.

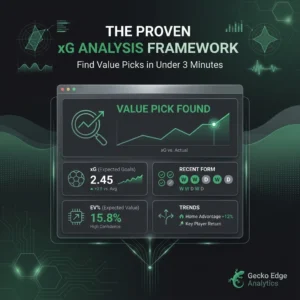

How AI and Live Data Change Everything

This is where tools like Gecko Edge transform your trading.

Raw match footage only tells part of the story. You need the numbers behind the pressure.

Expected goals (xG) in real-time. Shot quality metrics. Defensive actions per minute. Passing accuracy under pressure.

When the data confirms what your eyes are seeing, you have edge. When the data contradicts the visual, you have an even bigger edge.

Say you’re watching what looks like end-to-end action. Exciting football. The crowd is loving it.

But the data shows one team is creating chances worth 0.8 xG per shot, while the other is taking speculative efforts worth 0.1 xG each.

That’s not end-to-end football. That’s one team creating quality chances and another team making noise.

Trade accordingly.

The Mental Framework for Success

Most traders fail because they think like gamblers.

They see a good setup and bet their usual stake. They hit a winner and increase their stakes. They hit a loser and chase it back immediately.

Professional trading requires different thinking.

Position Sizing

Never risk more than 1-2% of your bank on a single trade. Ever.

I don’t care how certain the setup looks. I don’t care if Pep Guardiola himself texts you the game plan.

Small, consistent edges compound over time. Large stakes on “certain” outcomes destroy banks overnight.

Recording Everything

Keep a simple log: time, market, odds in, odds out, reasoning.

Review weekly. Look for patterns in your profitable trades. Look harder for patterns in your losing ones.

Most traders think they know why they win and lose. The data usually tells a different story.

Emotional Discipline

Football creates emotional responses. Goals, near-misses, controversial decisions.

Your profit comes from staying calm when others react emotionally.

When the stadium erupts after a wrongly disallowed goal, the markets swing wildly. While fans shout at their TVs, you’re quietly taking the other side of panicked trades.

Common Mistakes That Kill Profits

Overtrading

Not every match offers good trading opportunities. Some games are genuinely unpredictable. Others move in slow, obvious patterns that everyone can see.

Wait for your spots. Better to make three profitable trades per weekend than fifteen break-even ones.

Ignoring Match Context

A team down to ten men in the 30th minute creates different opportunities than one down to ten men in the 85th minute.

A 2-0 lead means different things depending on whether it’s Manchester City ahead or Brighton ahead.

Context shapes everything. The same scoreline in different circumstances requires completely different trading approaches.

Chasing Prices

You identify a good setup. The price is 2.20. You hesitate. It drops to 2.00. You panic and back it anyway.

This is how you turn winning strategies into losing ones.

If the price has moved beyond your edge, walk away. Another opportunity will come.

Building Your Trading Bank

Start small. Seriously small.

Take £100. Practice for three months. Focus on learning, not earning.

If you can’t show consistent profit with small stakes, larger ones won’t help. They’ll just accelerate your mistakes.

Once you prove your approach works, scale gradually. Double your stakes every quarter, not every week.

Trading football matches is a skill like any other. You wouldn’t expect to play piano concertos after a month of practice. Don’t expect to extract consistent profit from betting markets without similar dedication.

The markets are efficient enough to be challenging, inefficient enough to be profitable. Your job is finding those small gaps where preparation meets opportunity.

The best traders I know treat every match like a data point in a larger experiment. They win some, lose some, but always learn something.

Approach trading with that mindset, combine it with proper risk management and quality data, and you’ll give yourself a genuine edge in markets where edge is increasingly rare.

Start simple. Stay disciplined. Scale slowly.

The profits will follow.

LOG IN

LOG IN